3QFY2019 Result Update | Pharmaceutical

February 13, 2019

Sun Pharma

NEUTRAL

CMP

`428

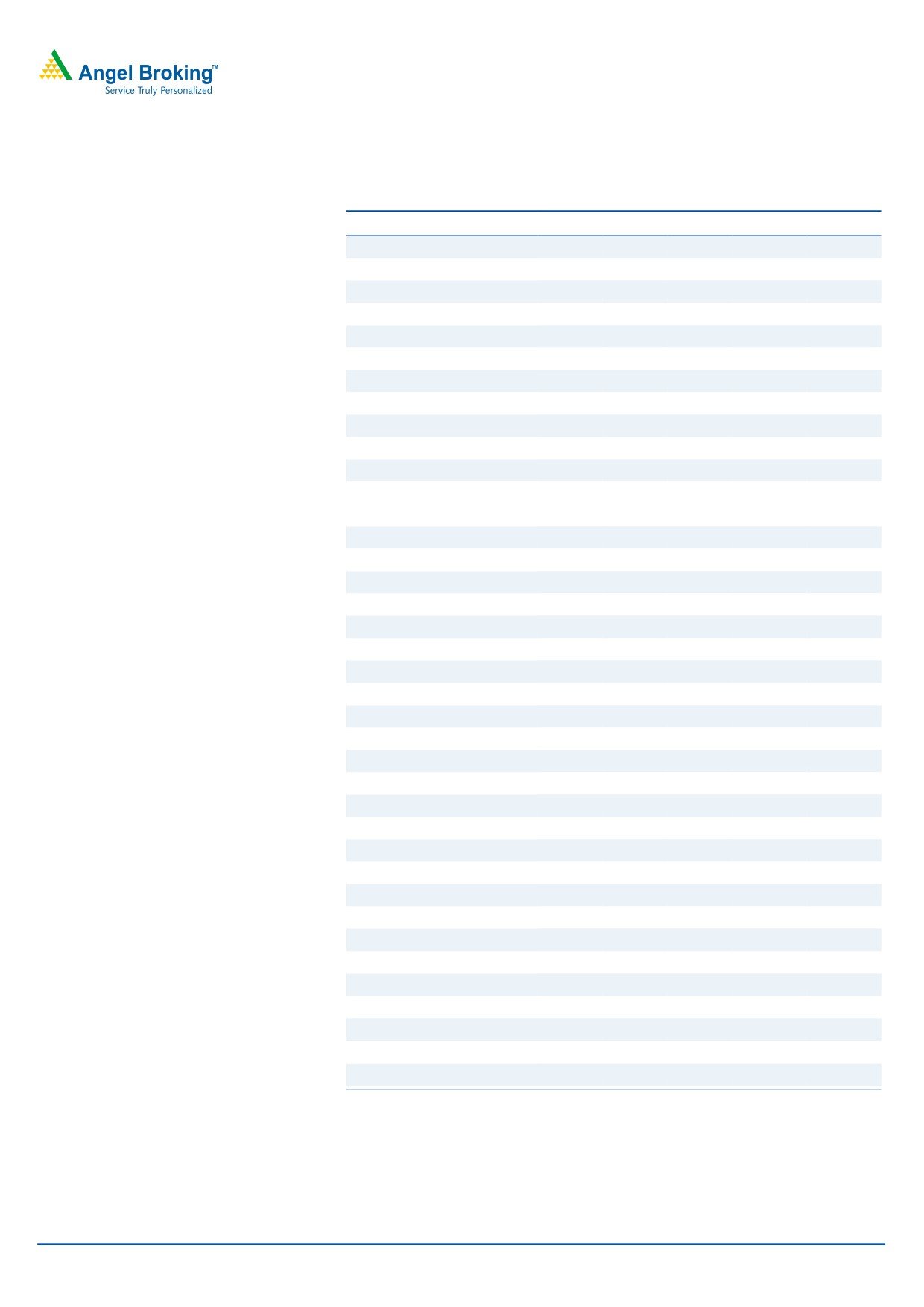

Performance Highlights

Target Price

-

% chg

(` cr)

3QFY2019 2QFY2019

% chg (qoq) 3QFY2018

Investment Period

12 months

(yoy)

Net sales

7,657

6,846

11.8

6,598

16.0

Other income

277

442

(37.5)

184

50.1

Sector

Pharmaceutical

Gross profit

5,491

5,089

7.9

4,498

22.1

Market Cap (` cr)

102,739

Operating profit

2,070

1,440

43.7

1,398

48.0

Net Debt (` cr)

(6,687)

Adj. Net profit

1,242

947

31.2

322

286.2

Beta

0.8

Source: Company, Angel Research

52 Week High / Low

679/375

For 3QFY2019, Sun Pharma posted robust numbers. For the quarter, the sales came in at

Avg. Daily Volume

186,302

`7,657cr v/s. `6,598cr in 3QFY2018, registering a yoy growth of 16.0%. India sales at

Face Value (`)

1

`2,235cr, were up by 7%, while US finished dosage sales at US$362mn up 10% yoy V/s

BSE Sensex

36,395

3QFY2018. On the OPM front, the gross margins came in at 71.7% v/s. 68.2% in

Nifty

10,889

3QFY2018, which lead the EBDITA margins to come in at 27.0% v/s. 21.2% in 3QFY2018.

Reuters Code

SUN.BO

This along with a 63.8% yoy dip in tax expenses led the Adj. net profit to come in at

Bloomberg Code

SUNP@IN

`1,242cr v/s. `322cr in 3QFY2018, a yoy growth of 286.2%. We maintain our Neutral.

Results better on all fronts: For 3QFY2019, Sun Pharma posted robust numbers. For the

Shareholding Pattern (%)

quarter, the sales came in at `7,657cr v/s. `6,598cr in 3QFY2018, registering a yoy growth

Promoters

54.4

of 16.0%. India sales at `2,235cr, were up by 7%, while US finished dosage sales at

MF / Banks / Indian Fls

15.2

US$362mn up 10% yoy V/s 3QFY2018. On the OPM front, the gross margins came in at

FII / NRIs / OCBs

21.6

71.7% v/s. 68.2% in 3QFY2018, which lead the EBDITA margins to come in at 27.0% v/s.

Indian Public / Others

8.8

21.2% in 3QFY2018. This along with a 63.8% yoy dip in tax expenses led the Adj. net profit

to come in at `1,242cr v/s. `322cr in 3QFY2018, a yoy growth of 286.2%. Consolidated

Abs. (%)

3m 1yr

3yr

R&D expense for 3QFY2019 was ` 465cr, or 6.1% of sales compared to `473cr or 7.2% of

Sensex

0.4

28.4

58.6

sales for 3QFY2018.

Sun Pharma

(6.0)

(34.6)

(48.5)

Outlook and valuation: Sun Pharma is expected to post net sales CAGR of 12.1%, while

EPS will post a CAGR of ~27% during FY2018-21E. The growth would be mainly driven by

improved product mix. However, given the concerns on corporate governance and risk-

3-year price chart

reward, we remain Neutral. Also, current valuations capturer the best-case scenario for

1,400

the company.

1,200

1,000

Key financials (Consolidated)

800

Y/E March (` cr)

FY2018

FY2019E

FY2020E

FY2021E

600

Net sales

26,489

28,725

32,929

37,340

400

% chg

(16.1)

8.4

14.6

13.4

200

Adj. Net profit

2,879

3,737

4,919

5,821

0

% chg

(58.5)

29.8

31.6

18.3

EPS (`)

12.0

15.6

20.5

24.3

Source: Company, Angel Research

EBITDA margin (%)

17.6

23.0

24.5

24.3

P/E (x)

35.7

27.5

20.9

17.6

RoE (%)

8.8

10.3

12.3

13.5

RoCE (%)

6.6

9.6

11.5

12.0

Sarabjit Kour Nangra

P/BV (x)

2.7

2.6

2.4

2.1

+91 22 39357600 Ext: 6806

EV/Sales (x)

3.6

3.3

2.8

2.4

EV/EBITDA (x)

20.7

14.6

11.5

9.8

Source: Company, Angel Research; Note: CMP as of February 11, 2019

Please refer to important disclosures at the end of this report

1

Sun Pharma | 3QFY2019 Result Update

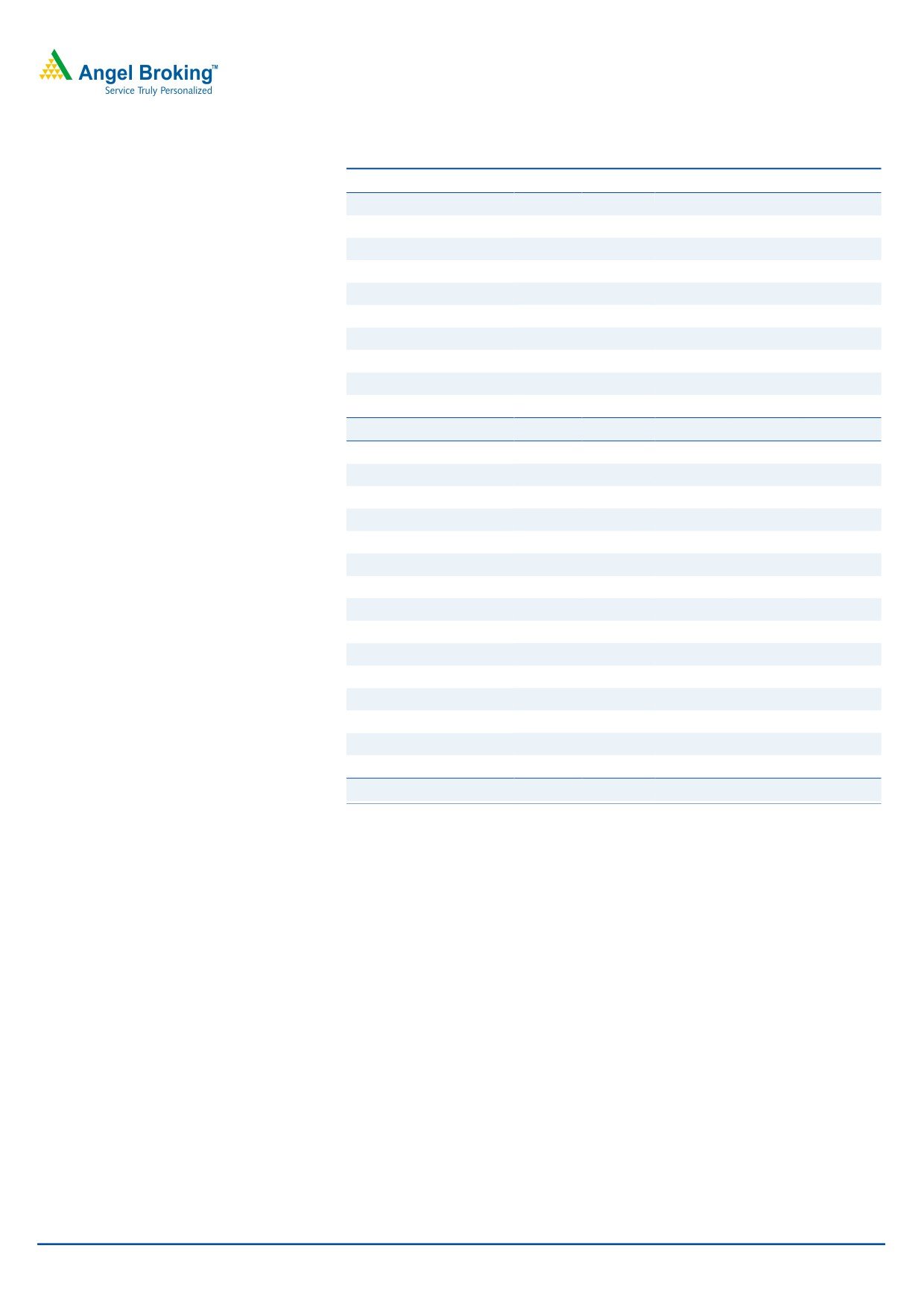

Exhibit 1: 3QFY2019 performance (Consolidated)

Y/E March (` cr)

3QFY2019

2QFY2019

% chg QoQ 3QFY2018

% chg yoy 9MFY2019 9MFY2018

% chg

Net sales

7,657

6,846

11.8

6,598

16.0

21,642

19,355

11.8

Other income

276.5

442.3

(37.5)

184.2

50.1

1,004

693

44.8

Total income

7,933

7,289

8.8

6,782

17.0

22,646

20,048

13.0

Gross profit

5,491

5,089

7.9

4,498

22.1

15,612

13,700

14.0

Gross margin (%)

71.7

74.3

68.2

72.1

70.8

Operating profit

2,070

1,440

43.7

1,398

48.0

5,031

3,767

33.5

Operating margin (%)

27.0

21.0

21.2

23.2

19.5

Interest

145

130

11.8

95

51.9

405

362

11.9

Depreciation

471

427

10.4

339

38.8

1,299

1,045

24.4

Extraordinary item loss/ ( gain)

0

1,214

0

1,214

951

PBT

1,730

1,326

30.5

1,148

50.7

4,330

3,054

41.8

Provision for taxation

270.9

269.7

0.5

748.7

(63.8)

630

1,121

(43.8)

PAT before extra-ordinary item

1,459

1,057

38.1

356

309.5

3,701

1,933

91.5

Minority interest(MI)

219

110

99.3

35

(459)

(229)

Adj. PAT

1,242

947

31.2

322

286.2

3,242

1,704

90.3

Reported PAT

1,242

(270)

-

322

286.2

2,028

753

169.2

Adj. EPS (`)

5.2

3.9

1.3

13.5

7.1

Source: Company, Angel Research

Sales improve sequentially: For 3QFY2019, the company posted robust

numbers. . For the quarter, the sales came in at `7,657cr v/s. `6,598cr in 3QFY2018,

registering a yoy growth of 16.0%. India sales at `2,235cr, were up by 7%, while US

finished dosage sales at US$362mn up 10% yoy V/s 3QFY2018.

Sales in the US were US$362mn for the quarter, a growth of 10% over same

period last year and accounted for 34% of total sales. For nine-month period,

sales were US$1,083mn recording a growth of 10% over same period last year. At

the same time, Taro posted 3QFY2019 sales of US$176mn, up 13% over

3QFY2018. For the nine month, sales were US$490mn, marginally up over nine-

month last year. Taro’s net profit for 3QFY3019 was US$93mn while for the nine-

month period; it reported a net profit of US$223mn. The company had 441

ANDAs filed with the USFDA. Currently, ANDAs for 123 products await USFDA

approval, including 15 tentative approvals.

Sale of branded formulations in India for 3QFY2019 was `2,235cr, up by 7% and

accounting for 29% of total sales. For the nine month, sales were at `6,247cr, up

by 3% over same period last year. Sun Pharma is ranked No. 1 and holds

approximately 8.2% market share in the over `129,000cr Indian pharmaceutical

market as per AIOCD AWACS December-2018 report. For 3QFY2019, the

company launched 20 new products in the Indian market.

Sales in emerging markets were at US$203mn for 3QFY3019; up 7% over same

quarter last year and accounted for 19% of total sales. For the nine month, sales

were at US$594mn, up by 8% yoy over the nine-month period last year.

Formulation sales in Rest of World (ROW) markets excluding US & Emerging

Markets were US$125mn in 3QFY2019, a growth of 4% over 3QFY2018 &

February 13, 2019

2

Sun Pharma | 3QFY2019 Result Update

accounting for approximately 12% of revenues. For the nine month, sales were

US$340mn, down 2% over nine-month last year.

API business imparts benefits of vertical integration for our formulations business.

We continue to increase the API supply for captive consumption for key products.

For Q3FY19, external sales of API were at `426cr, up by 15% over 3QFY2018. For

the nine month, API sales were at `1,247cr, up by 17% over nine-month in FY2018.

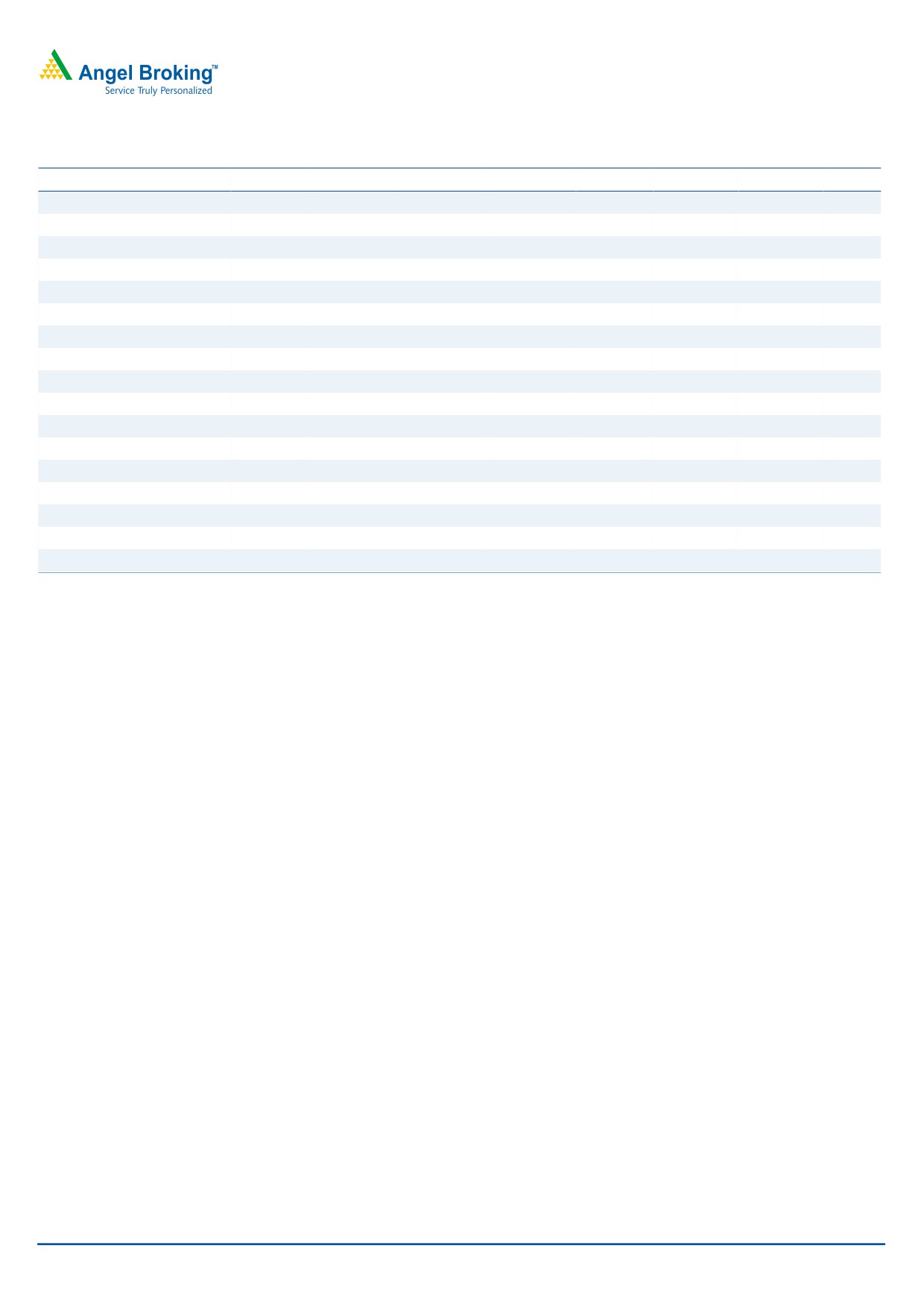

Exhibit 2: Sales trend

5657

6000

4987

4987

4513

4748

5000

4000

3000

2085

2152

1963

2000

1860

2000

1000

0

3QFY2018

4QFY2018

1QFY2019

2QFY2019

3QFY2019

Domestic Formulation

Export Formulation, Bulk and others

Source: Company, Angel Research

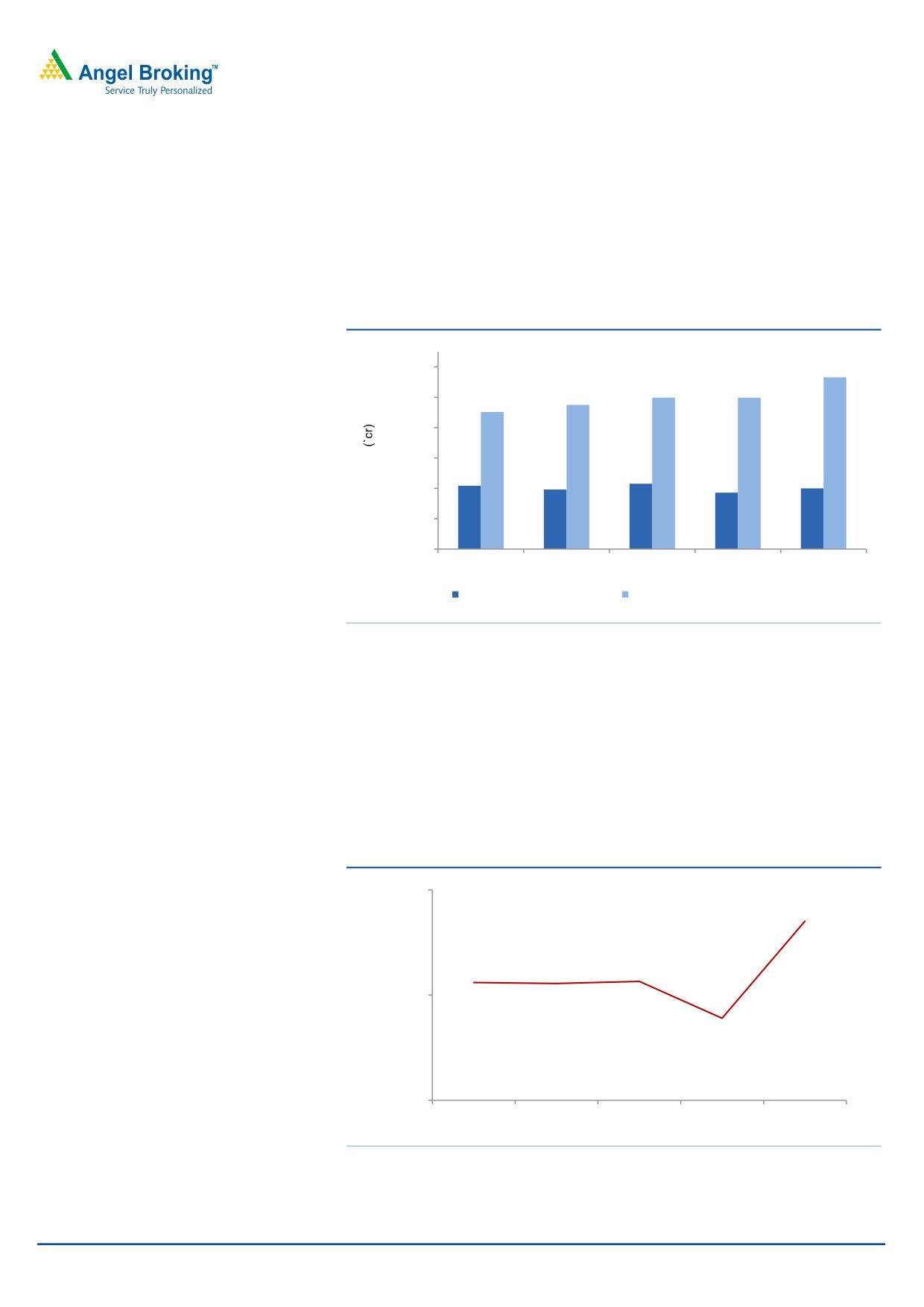

OPM at 27.0%, qoq higher than 17.8% in 2QFY2018: On the OPM front, the

gross margins came in at 71.7% v/s. 68.2% in 3QFY2018, which lead the EBDITA

margins to come in at 27.0% v/s. 21.2% in 3QFY2018. This mainly came in on back

of gross margin expansion (which improved on back of improved product mix)

along with a 2.1% yoy dip in the SG&A expenses. Consolidated R&D expense for

3QFY2019 was ` 465cr, or 6.1% of sales compared to `473cr or 7.2% of sales for

3QFY2018. For the nine month, R&D expense was `1,417cr’ or 6.5% of sales.

Exhibit 3: OPM trend (percentage)

30.0

27.0

21.3

21.2

21.1

20.0

17.8

10.0

3QFY2018

4QFY2018

1QFY2019

2QFY2019

3QFY2019

Source: Company, Angel Research,

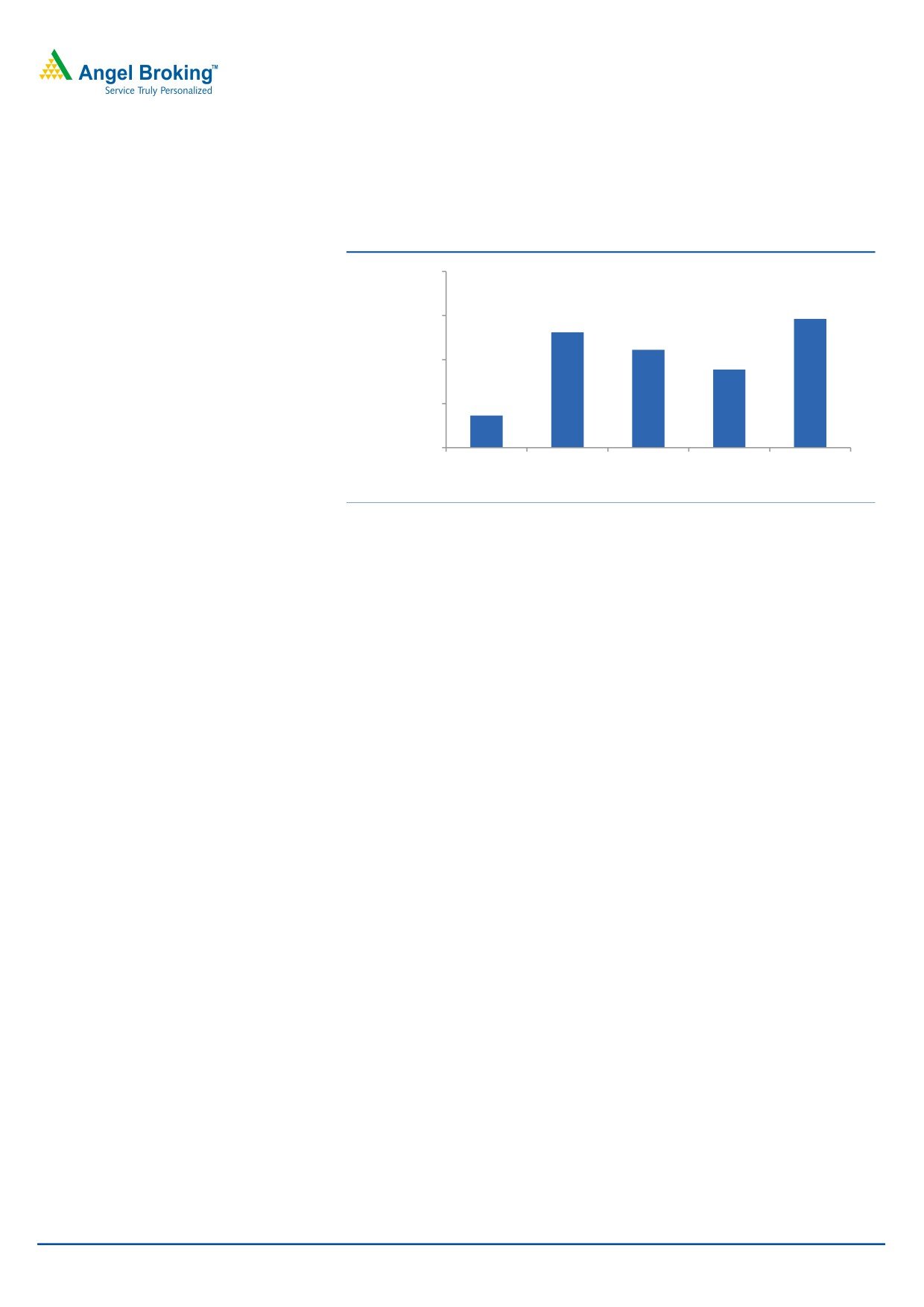

Net profit slightly better on back of low taxes: OPM expansion aided along

with a 63.8% yoy dip in tax expenses led the Adj. net profit to come in at `1,461cr

February 13, 2019

3

Sun Pharma | 3QFY2019 Result Update

v/s. `364cr in 3QFY2018, a yoy growth of 300.9%. In addition, there was a 50.1%

yoy rise in other income.

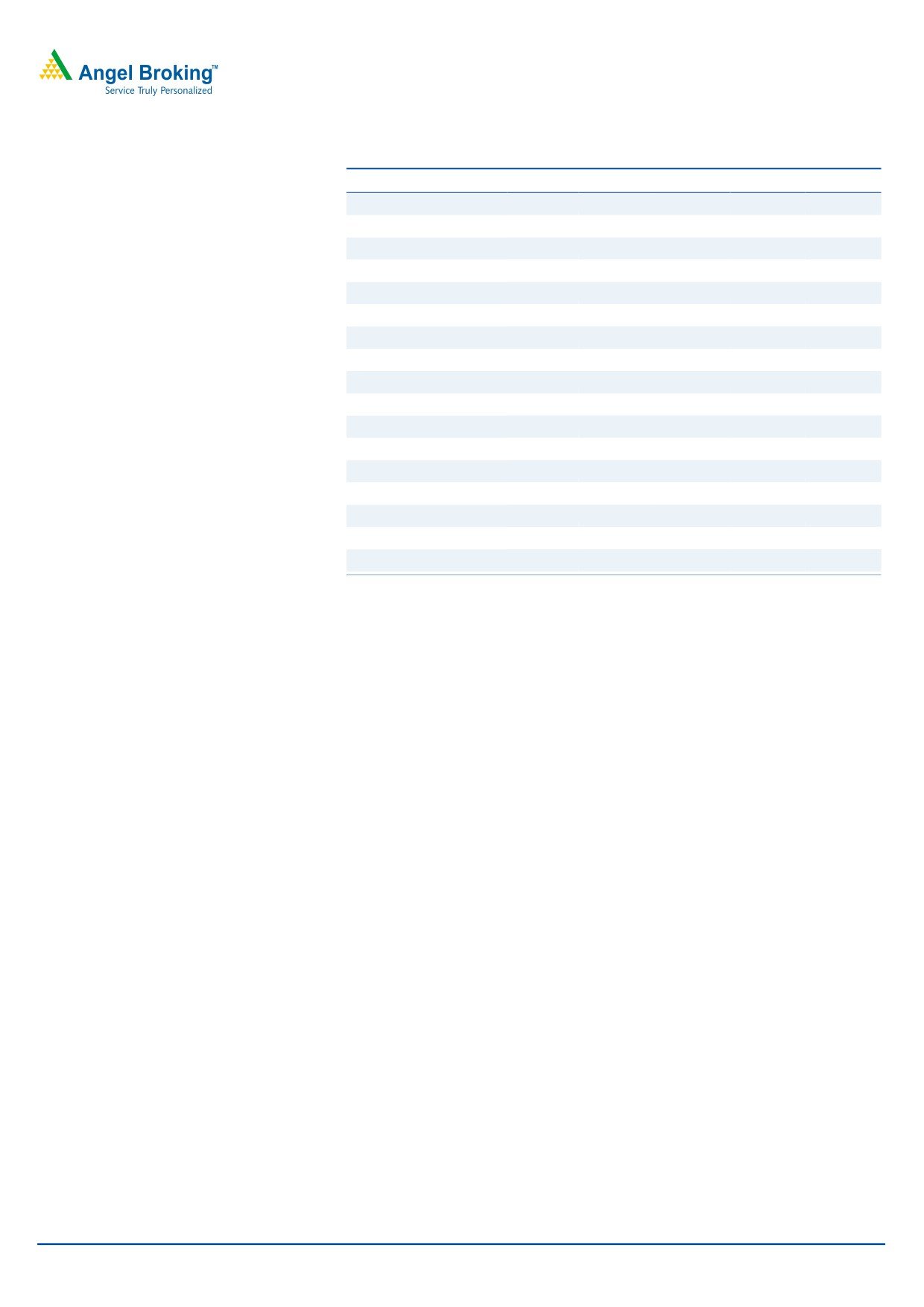

Exhibit 4: Adjusted Net profit trend (` cr)

2,000

1,461

1,500

1,309

1,111

1,000

887

500

365

0

3QFY2018

4QFY2018

1QFY2019

2QFY2019

3QFY2019

Source: Company, Angel Research

Concall Takeaways

Sun pharma is in the process of transitioning distribution from Aditya

Medisales to wholly owned subsidiary.

On the Atlas transaction, the company has provided loan of US$300mn to

Sun Pharmaceuticals in FY2018 as per supply contract terms and conditions,

since the company was unable to fulfill the supply obligation due to GMP

issues at Halol. On the loan of US$300mn, Sun Pharmaceuticals, guided that it

will unwind the transaction, which will result in assignment of supply contract

to one of wholly owned subsidiary and Atlas moving out of the transaction.

Hence, on a consolidated basis in FY2019, US$300mn loan will be squared off

against unfulfilled supply obligation.

In the domestic business, covered market of Sun Pharmaceuticals is growing

at ~11% yoy.

Investment arguments

Strong ANDA pipeline; with specialty products to gain strength: Sun

Pharma, in terms of ANDAs, cumulatively has 441 products, out of which 123

products now await USFDA approval, including 15 tentative approvals. With the

merger of Ranbaxy Laboratories, the company is now the fifth-largest specialty

generics company in the world (behind Teva, Sandoz, Activas and Mylan). Apart

from the generic product portfolio, the company is also developing specialty

product portfolio. During FY2018, the specialty product business grossed sales of

~US$300mn constituting around 24-25% of US sales. Currently only Absorica

drives the sales and DUSA acquired products.

Going forward, the sales will be driven by products acquired or in-licensed by the

company; namely- Ilumya, Cequa, Yonsa, & Xelpros. These products will drive

growth of the US sales of the company mainly from FY2020-21E. Overall, we

expect the region to post a CAGR of 14.0% in sales over FY2018-21E, accounting

for almost ~35% of the overall sales in FY2021E.

February 13, 2019

4

Sun Pharma | 3QFY2019 Result Update

Domestic business: Sun Pharma’s domestic formulation business is among the

fastest growing in the Indian pharmaceutical industry. It contributed 23% to the

company’s total turnover in FY2014. Sun Pharma, with Ranbaxy Laboratories’

merger, is now the segment leader with a market share of 8.3% in the domestic

formulation market, followed by Abbott India, which has a market share of 6.3%.

This is a significant gap considering that the segment is highly fragmented.

In addition, the company is market leader in the chronic segments and has a well-

diversified product basket. Top 10 Brands contribute ~17% of India revenues.

Thus, growth is driven by a basket of brands, a very low product concentration. In

addition, the company has the highest field productivity of around `0.86cr/MR V/s

0.52cr/ MR - which is the industry average. Overall, we expect the domestic

formulation

business

to

post

a

CAGR of

12.3%

over

FY2018-21E, contributing ~30% to the overall formulation sales of the company in

FY2021.

Healthy balance sheet: Sun Pharma has one of the strongest balance sheets in

the sector with cash of ~`10,000cr. The same can continue to support the

Management in inorganic growth and in scouting for acquisitions, especially in

the US and in emerging markets.

Corporate governance issues weighing on the company: During

3QFY2019, various issues related to corporate governances, which mainly were

financial in nature like third party loans, increasing contingent liabilities related to

taxes on balance sheet amongst others. Over, this quarter the company has

committed to clean up the issues two of which prominent are its arrangement

with Aditya Medisales, which was used to distribute the products of the company

and with effect from 1QFY2020, will become its wholly owned subsidiary). The

other one is unwinding the US$345mn loan given to Atlas Global Trading by Sun

Pharmaceuticals against the supply obligation that Sun has on its balance sheet as

liability. The loan was given to Atlas in lieu of Sun Pharma’s inability to supply

certain products due to Halol warning letter. This unwinding will be concluded in

FY2019 itself. While company has clarified these two issues, we still are not

convinced, as there are other issues, which will weigh on its corporate

governance; some of which are still unanswered.

Outlook and valuation: Sun Pharma is expected to post net sales CAGR of

12.1%, while EPS will post a CAGR of ~27% during FY2018-21E. The growth would

be mainly driven by improved product mix. However, given the concerns on

corporate governance and risk-reward, we remain Neutral. Also, current

valuations capturer the best-case scenario for the company.

Company background

Sun Pharma is an international specialty pharma company, with a large presence

in the US and India, and a footprint across other markets. In India and rest of the

world markets, the key chronic therapy areas for the company are cardiology,

psychiatry, neurology, gastroenterology, diabetology, etc. The company is a

market leader in specialty therapy areas in India. In India, the company has

emerged as a leading pharma company, where it is the first leading player. In

addition, in the US, a key geography, the company has expanded significantly

through both in-organic and organic routes.

February 13, 2019

5

Sun Pharma | 3QFY2019 Result Update

Profit & Loss statement (Consolidated)

Y/E March (` cr)

FY2017

FY2018

FY2019E FY2020E FY2021E

Gross sales

31,850

26,746

29,010

33,251

37,707

Less: Excise duty

272

257

285

322

367

Net sales

31,578

26,489

28,725

32,929

37,340

Other operating income

160

132

132

132

132

Total operating income

31,739

26,622

28,857

33,061

37,472

% chg

10.6

(16.1)

8.4

14.6

13.3

Total expenditure

21,489

21,832

22,132

24,859

28,275

Net raw materials

8,131

7,425

7,756

8,232

8,588

Other mfg costs

1,380

1,157

1,255

1,439

1,631

Personnel

4,902

5,367

5,796

6,956

8,347

Other

7,076

7,883

7,287

8,517

9,654

EBITDA

10,089

4,658

6,593

8,070

9,065

(% of Net Sales)

31.9

17.6

23.0

24.5

24.3

Depreciation & amort.

1,265

1,500

1,764

1,880

1,996

EBIT

8,985

3,290

4,961

6,322

7,202

% chg

(19.9)

(63.4)

50.8

27.4

13.9

(% of Net Sales)

28.5

12.4

17.3

19.2

19.3

Interest & other charges

400

518

612

600

600

Other income

463

707

1,201

1,306

1,554

(% of PBT)

5.1

20.3

21.6

18.6

19.1

Share in profit of Asso.

-

-

-

-

Recurring PBT

9,048

3,479

5,551

7,028

8,156

% chg

-18.0

0.0

0.0

0.0

0.0

Extraordinary expense/(inc.)

-

(720)

1,214

-

1.0

PBT (reported)

9,048

3,479

4,337

7,028

8,155

Tax

1,211.6

845.2

867.3

1,405.7

1,630.9

(% of PBT)

13.4

24.3

20.0

20.0

20.0

PAT (reported)

7,836

2,634

3,469

5,623

6,524

Add: Share of earnings of asso.

10

(25)

(25)

(25)

(24)

Less: Minority interest (MI)

882

447

678

678

678

Prior period items

-

-

-

-

PAT after MI (reported)

6,964

2,162

2,766

4,919

5,821

ADJ. PAT

6,932

2,879

3,737

4,919

5,821

% chg

46.2

(69.0)

27.9

77.9

18.3

(% of Net Sales)

1.0

2.0

3.0

4.0

5.0

Basic EPS (`)

28.9

12.0

15.6

20.5

24.3

Fully Diluted EPS (`)

28.9

12.0

15.6

20.5

24.3

% chg

26.2

(58.5)

29.8

31.6

18.3

February 13, 2019

6

Sun Pharma | 3QFY2019 Result Update

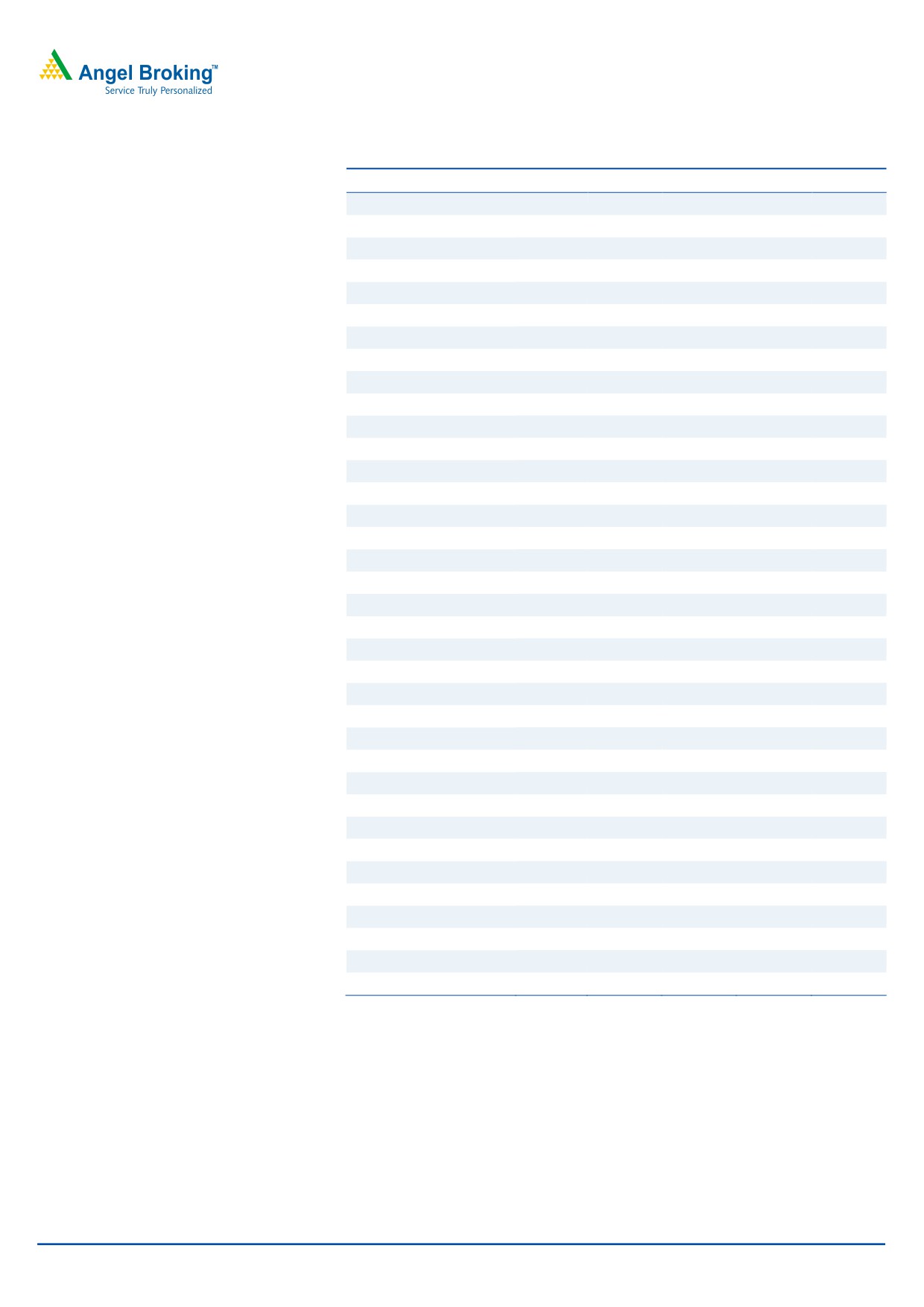

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2017

FY2018

FY2019E FY2020E FY2021E

SOURCES OF FUNDS

Equity share capital

240

240

240

240

240

Preference capital

Reserves & surplus

36,400

37,861

39,504

43,300

47,998

Shareholders’ funds

36,640

38,101

39,744

43,540

48,238

Minority interest

3,791

3,884

4,562

5,240

5,918

Total loans

9,832

10,385

10,000

10,000

10,000

Deferred tax liability

(2,178)

(1,975)

(1,975)

(1,975)

(1,975)

Other Long Term Liabilities

-

-

-

-

Long Term Provisions

1,342

463

443

497

565

Total liabilities

49,426

50,858

52,774

57,303

62,747

APPLICATION OF FUNDS

Gross block

13,399

14,876

16,876

18,876

20,876

Less: Acc. depreciation

6,791

8,096

9,860

11,740

13,736

Net block

6,608

6,780

7,016

7,136

7,140

Capital work-in-progress

2,801

2,465

2,465

2,465

2,465

Goodwill

5,537

5,607

5,607

5,607

5,607

Investments

5,531

6,466

6,466

6,466

6,466

Long term long & adv.

1,192

7,143

7,507

7,417

7,713

Current assets

4,526

6,103

6,375

6,767

7,059

Cash

32,723

27,545

28,743

34,256

40,869

Loans & advances

15,141

9,929

9,731

12,662

16,610

Other

2,480

2,265

2,366

2,511

2,620

Current liabilities

15,102

15,351

16,647

19,083

21,639

Net current assets

9,491

11,251

11,406

12,811

14,572

Others

23,231

16,294

17,338

21,445

26,297

Total assets

49,426

50,858

52,774

57,303

62,747

February 13, 2019

7

Sun Pharma | 3QFY2019 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2017

FY2018

FY2019E FY2020E FY2021E

Profit before tax

9,048

3,479

5,551

7,028

8,156

Depreciation

1,265

1,500

1,764

1,880

1,996

(Inc.)/Dec in working capital

(1,600)

(12,467)

(2,417)

(2,933)

(4,279)

Direct taxes paid

1,212

845

867

1,406

1,631

Cash Flow from Operations

7,502

(8,333)

4,030

4,570

4,242

(Inc.)/Dec.in Fixed Assets

(80)

(1,141)

(2,000)

(2,000)

(2,000)

(Inc.)/Dec. in Investments

1,524

(5,951)

(364)

90

(296)

Other income

-

-

-

-

-

Cash Flow from Investing

1,444

(7,092)

(2,364)

(1,910)

(2,296)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

(2,214)

(1,433)

365

55

68

Dividend Paid (Incl. Tax)

(1,123)

(1,123)

(1,123)

(1,123)

(1,123)

Others

(3,650)

12,770

(1,106)

1,339

3,057

Cash Flow from Financing

(6,986)

10,215

(1,864)

271

2,002

Inc./(Dec.) in Cash

1,959

(5,211)

(198)

2,931

3,948

Opening Cash balances

13,182

15,141

9,929

9,731

12,662

Closing Cash balances

15,141

9,929

9,731

12,662

16,610

February 13, 2019

8

Sun Pharma | 3QFY2019 Result Update

Key Ratios

Y/E March

FY2017

FY2018

FY2019E FY2020E FY2021E

Valuation Ratio (x)

P/E (on FDEPS)

14.8

35.7

27.5

20.9

17.6

P/CEPS

12.5

28.1

22.7

15.1

13.1

P/BV

2.8

2.7

2.6

2.4

2.1

Dividend yield (%)

0.8

0.5

0.5

0.5

0.5

EV/Sales

3.1

3.6

3.3

2.8

2.4

EV/EBITDA

9.7

20.7

14.6

11.5

9.8

EV / Total Assets

2.0

1.9

1.8

1.6

1.4

Per Share Data (`)

EPS (Basic)

28.9

12.0

15.6

20.5

24.3

EPS (fully diluted)

28.9

12.0

15.6

20.5

24.3

Cash EPS

34.3

15.3

18.9

28.3

32.6

DPS

3.5

2.0

2.0

2.0

2.0

Book Value

152.3

158.4

165.2

181.0

200.5

DuPont Analysis

EBIT margin

28.5

12.4

17.3

19.2

19.3

Tax retention ratio

86.6

75.7

80.0

80.0

80.0

Asset turnover (x)

1.0

0.7

0.7

0.8

0.8

ROIC (Post-tax)

25.7

6.7

9.5

11.6

12.7

Cost of Debt (Post Tax)

3.7

7.5

5.3

4.8

4.7

Leverage (x)

0.0

0.0

0.0

0.0

0.0

Operating ROE

25.7

7.9

9.5

11.6

12.7

Returns (%)

ROCE (Pre-tax)

18.6

6.6

9.6

11.5

12.0

Angel ROIC (Pre-tax)

40.1

11.2

14.6

17.7

19.3

ROE

22.4

8.8

10.3

12.3

13.5

Turnover ratios (x)

Asset Turnover (Gross Block)

2.3

1.9

1.8

1.8

1.9

Inventory / Sales (days)

76

94

91

95

100

Receivables (days)

68

96

91

95

100

Payables (days)

74

95

94

94

94

WC cycle (ex-cash) (days)

96

44

101

93

78

Solvency ratios (x)

Net debt to equity

(0.1)

0.0

0.0

(0.1)

(0.1)

Net debt to EBITDA

(0.5)

0.1

0.0

(0.3)

(0.7)

Interest Coverage (EBIT/Int.)

-

-

-

-

-

February 13, 2019

9

Sun Pharma | 3QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in

securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of

securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Disclosure of Interest Statement

Sun Pharma

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

No

relatives

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

February 13, 2019

10